The Tax Cloud Expertise

Tax Cloud was created by Myriad, a leading innovation funding consultancy in the UK and Ireland. We help enterprises navigate, apply for and secure tax incentives and grants.

Myriad saw that some SMEs were losing out on claiming their entitlement as their claims were not large enough to support the high percentage fees usually charged. Tax Cloud offers these companies the opportunity to prepare their own claim with the peace of mind that comes with using a R&D tax consultant, without the high fees.

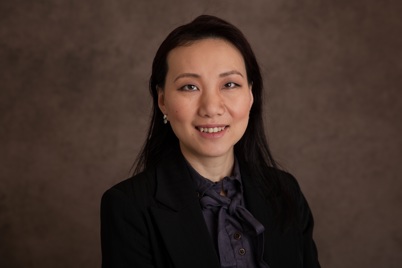

Who is Myriad?

Myriad is not just another tax incentives consultancy, we're the only one that eliminates your risk.

Our promise to you is simple: we stand firmly behind our advice. If your claim is challenged by HMRC, we'll defend it free of charge. If your claim is rejected, we won't charge you any fees, we'll cover any HMRC penalties and even compensate you for your time.

- Submitting R&D tax claims since 2001

- Over £70m claimed and counting

- Industry-leading specialists, including technical, costing and tax experts

- Success fee only

More than just a portal

With Tax Cloud, you’re never guessing when making your claim. You will be supported by leading technical, costing and tax experts who review your claim at every stage and are available to answer any questions you have.

Phone and email support

Help text & tutorial videos

Live chat support function